If you would like to be kept informed of our efforts, news, and events, please take a moment to sign up to receive our Newsletter.

Autism Acceptance Month is always a busy one at Autism Society of Texas!

We kicked off the month with our Eclipse event in partnership with Thinkery, William’s School, and Joshua’s Stage.

We hosted our Virtual Texas Autism Walk Resource Fair to connect organizations serving our community with Autistic individuals and their loved ones across the state.

We took part in the Any Baby Can Walk in San Antonio and met with families.

Autism Acceptance Month is always a busy one at Autism Society of Texas!

We kicked off the month with our Eclipse event in partnership with Thinkery, William’s School, and Joshua’s Stage.

We hosted our Virtual Texas Autism Walk Resource Fair to connect organizations serving our community with Autistic individuals and their loved ones across the state.

We took part in the Any Baby Can Walk in San Antonio and met with families.

We finished off April with our first Rio Grande Valley Family Fun Day, which connected families from the Autism community with resources and organizations that support Autistic individuals and their loved ones.

We finished off April with our first Rio Grande Valley Family Fun Day, which connected families from the Autism community with resources and organizations that support Autistic individuals and their loved ones.

📢 Important Announcement: 16th Annual Texas Autism Walk Venue Change! 📢

Dear Participants, Sponsors, and Supporters,

In light of recent concerns regarding our previously selected venue, we have made the decision to relocate and reschedule this year’s event. Our top priority is to ensure a fantastic and inclusive experience for all participants, sponsors, and exhibitors.

For those of you already registered, we are thrilled by your commitment to joining us for the 16th Annual Texas Autism Walk, and we deeply appreciate your ongoing support. For those of you not registered yet, we’d love to have you join us, and registration fees include Volente Beach admission! We are thrilled to be able to accommodate additional participants and sponsors at our new location!

New Date and Location:

Date: Saturday, May 11, 2024

Location: Volente Beach, 16107 FM 2769, Leander, TX 78641

Volente Beach offers a boutique waterpark experience, featuring four acres of Lake Travis waterfront, complete with a beach, two swimming pools, grassy play areas, and a sand volleyball court. The Texas Autism Walk festivities and resource fair will be held on the lawn and picnic area near the stage.

Guests will enjoy exclusive access to Volente Beach water activities from 9 AM to 12 PM, with a special focus on Autism-friendly accommodations. Families are welcome to stay and enjoy the park for the remainder of the day at no additional charge. We will also have lots of wonderful exhibitors, crafts and activities on the lawn and picnic area.

Registration & Event Info Here

Questions:

What if I don’t want to participate in the water park activities?

That’s ok! We’ll have plenty to do at the Resource Fair and Walk! Volente Beach has a lovely lawn with picnic tables and participants may bring towels or blankets for the lawn. There will be many participants who do not utilize the water park attractions, and we’ll have all of our festivities on the lawn and picnic area. Our actual Walk will be on the beach which is next to the picnic area.

Is there an additional cost?

There is no change in fees. If you are already registered -your water park admission is now included. If you are about to register, your water park admission fees are also included. There are no water park admission fees for exhibitors, sponsors, participants and volunteers.

What about parking?

Parking is free for everyone. If you are a participant, sponsor, exhibitor or volunteer, please tell the Parking Attendant that you are with the Autism Walk, and they will give you a free pass for your dashboard. Parking lot is adjacent to the venue and will be signed.

What about safety?

Volente Beach lifeguards will be on duty in all water areas. We will have volunteers staged along the lake edge. The lake is currently experiencing a significant lack of water due to severe drought, and Volente Beach’s lake swimming area has completely dried up. (It’s currently an overflow parking lot). Due to the drought, the lake water is quite a distance from the water park and lawn, however, we do plan to have volunteers at the perimeter of the park on the lake side.

We have some water safety social stories on our website and encourage families to utilize them. https://www.texasautismsociety.org/wp-content/uploads/2023/06/Water-Social-Story.pdf

How will this be Autism-Friendly?

A huge thank you to Volente Beach for helping us to make this an Autism-friendly event! We will have some revised rules only from 9-12, our exclusive time. At noon, Volente Beach’s usual rules will apply when the park opens to the public.

From 9 AM-12 noon:

- Pirate Ship play area- Available to all ages during our event time.

- Water slides – Parent/caregiver and child are allowed on the water slide together during our event time if needed for safety or support.

- Lifeguards – Will get the attention of the parent/caregiver first and try not to blow whistles, unless it’s an emergency. Please help the lifeguards by reminding your child to walk near the water attractions!

Are pets allowed?

Only service animals are allowed.

Will food and drink be available? Can I bring a water bottle?

Yes, yes, and yes! Starbucks is donating coffee and beverages for our event and will be onsite to hand them out! Volente Beach will have food and drinks available for purchase and will have gluten free and dairy free options. Water bottles are allowed and we’ll have a couple of water refill stations and cups available too. Volente Beach will also have bottled water available for sale for those that prefer to purchase it.

—-

If you have additional questions, please reach out to me at jacquie@texasautismsociety.org or call our office at 512-479-4199.

Thank you for your flexibility, understanding, and unwavering support for the Autism community!

Warm regards,

Jacquie Benestante

Executive Director, Autism Society of Texas

This March, we held one of two Virtual Sensory Friendly Healthcare trainings for healthcare professionals to help improve healthcare experiences for the neurodivergent community!

This March, we held one of two Virtual Sensory Friendly Healthcare trainings for healthcare professionals to help improve healthcare experiences for the neurodivergent community!

Our SE Houston group had their Easter celebration event for families.

We also presented to multiple community organizations as part of Thinkery’s Joyful Learning Collaborative to provide opportunities for our community to engage with and enjoy the solar eclipse. As part of this initiative, we have created resources for parents to help their children prepare for this special event. Check out our solar eclipse resources on our website here!

We were also hard at work getting ready for Autism Acceptance Month, including preparations for our Texas Autism Walk!

There are many ways you can support our work for the Texas Autism community this April! Create your own Give Back Event, start a friends, family or business Autism Walk team, or participate virtually and we’ll ship you a tee! Check out our Autism Acceptance resources and find a way to get involved!

The Connection is You.

We are so excited Jamba has partnered with Autism Society of Texas again this April!

We are so excited Jamba has partnered with Autism Society of Texas again this April!

Every Thursday in April, mention AST at participating locations and 20% of your total will be donated to Autism Society of Texas!

Thank you so much to Donna and the entire Jamba Texas team for organizing this amazing giveback event! Check out the list of participating Jamba locations below.

| 5923 Greenville Ave | Dallas, TX 75206 |

| 6440 N MacArthur Blvd., #150 | Irving, TX 75039 |

| 1201 E Spring Creek Pkwy., #180 | Plano, TX 75074 |

| 13350 North Dallas Pkwy., Ste 3373 | Dallas, TX 75240 |

| Hulen Street: 4811 Overton Ridge Blvd., #216 | Fort Worth, TX 76132 |

| Camp Wisdom: 3040 Camp Wisdom Rd., Ste 100 | Grand Prairie, TX 75052 |

| 2515 Post Oak Blvd., Ste A | Houston, TX 77056 |

| 528 W Bay Area Blvd., #300 | Webster, TX 77598 |

| 23501 Cinco Ranch Blvd. #F110 | Katy, TX 77494 |

| 2810 Business Center Dr., Ste 138 | Pearland, TX 77584 |

| 5425 S Padre Island Dr., Ste 112 | Corpus Christi, TX 78411 |

| 4300 W Waco Drive A-4 | Waco, TX 76710 |

| 1201 Barbara Jordan Blvd., #1295 | Austin, TX 78723 |

| 290 E Basse Rd. #101 | San Antonio, TX 78209 |

| 5535 W Loop 1604 N, #101 | San Antonio, TX 78251 |

| 8603 State Hwy 151, #101 | San Antonio, TX 78245 |

This February, some of our AST team had the privilege of meeting with and hearing from Temple Grandin at the Paramount Theatre. We are so grateful to the Paramount Theatre for providing us with this incredible opportunity as well as for all of their continued support throughout the years!

We were thrilled to train almost 100 healthcare professionals at the new north Austin location of Texas Children’s Hospital Austin and also provided them with 30 sensory kits. We are so excited to have Autism-friendly hospitals!

We had a fantastic time at the #TeamAutism Mile 19 Aid Station at the Austin Marathon! Thank you so much to our amazing runners and volunteers, as well as all of you who donated to help us hit our $10K Moody Match. Kudos to the Austin Marathon staff for their impeccable organization and a big thank you to the Moody Foundation for supporting area nonprofits through matching funds!

We loved connecting with our community at the Region 20 Transition Symposium Community Outreach hosted by Partners Resource Network and The Arc of San Antonio!

We had a fantastic time at the #TeamAutism Mile 19 Aid Station at the Austin Marathon and we have so many people and organizations to thank for making this year’s marathon partnership the best one yet!

We had a fantastic time at the #TeamAutism Mile 19 Aid Station at the Austin Marathon and we have so many people and organizations to thank for making this year’s marathon partnership the best one yet!

We want to give a huge thank you to the following:

All of our #TeamAutism Runners with a big thank you to our top fundraisers- Jackson Roblow & Patricia Rosen • Thanks to the following Runners for fundraising & supporting Autism Society of Texas- Mary Kristen Cokinos, Hyoselin Chavez, and Jessen O’Fallon

More thank you’s to our amazing group of volunteers, supporters, and in-kind donors:

Ashleigh Alvarez and the ACES Austin Team • Bill Miller BBQ • Houndstooth Coffee • Fleet Feet Austin • Endurance Nation • Ashley Underwood, Advent Health Rollins Brook • Members of Gilbert’s Gazelles • Our volunteers at the Mile 19 Aid Station

Thank you so much to the Austin Marathon staff for their impeccable organization and the Moody Foundation for supporting area nonprofits through matching funds!

Our February newsletter is out! Read the AST newsletter now 📰

Our February newsletter is out! Read the AST newsletter now 📰 We started off 2024 with a free Seminars Across the Spectrum education event on toilet training strategies with guest speakers Dr. Hannah MacNaul, Ph.D., BCBA-D, LBA, LSSP, and Janet Firestone.

We started off 2024 with a free Seminars Across the Spectrum education event on toilet training strategies with guest speakers Dr. Hannah MacNaul, Ph.D., BCBA-D, LBA, LSSP, and Janet Firestone.

We also took part in the Thinkery’s Joyful Learning Collaborative session at the Texas School for the Blind in preparation for the collaborative Eclipse events happening in April!

Registration opened for our Texas Autism Walk, happening April 28th at Dreamland in Dripping Springs.

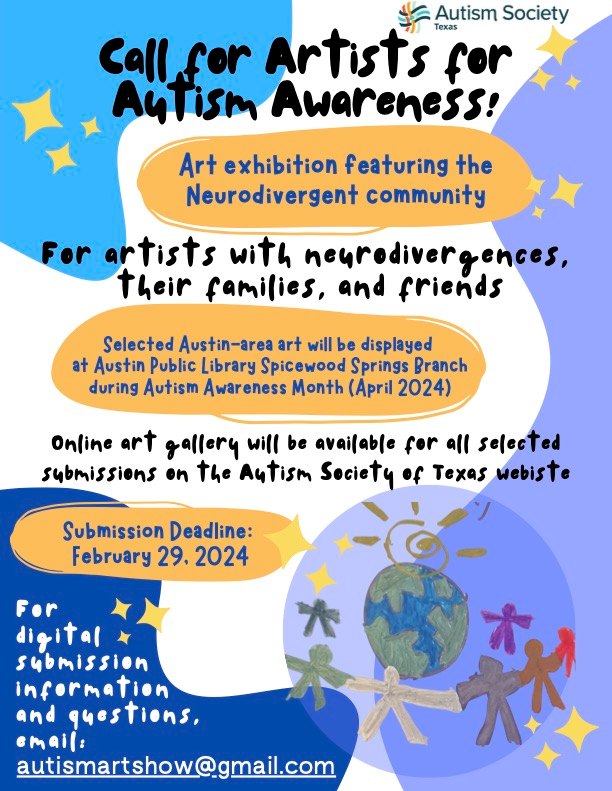

We also opened submissions for the Autism Art Show happening in April (Deadline is 02/29 to submit artwork)!

Registration is open for AST’s 16th Annual Texas Autism Walk happening on Sunday, April 28th at Dreamland in Dripping Springs, TX. Attendees will walk a 1 mile loop around the Dreamland grounds and then reconvene afterwards for an interactive Resource Fair, family friendly activities, and live music all in support of the Texas Autism community.

The Texas Autism Walk happens every April to celebrate Autism Acceptance Month (formerly recognized as Autism Awareness Month) and bring together individuals in the Texas Autism community. 100% of funds raised from the Texas Autism Walk support Autism Society of Texas’ work creating connections for Autistic people and their loved ones across the state of Texas.

Now thru February 16th, register and save $10 per ticket with our early bird discount. Sponsorships for the 2024 Texas Autism Walk are also open now and all sponsorship levels include a resource fair organization spot. Learn more about our sponsorships levels and sign up today here!